Do you realize your home equity can be one of your greatest financial resources?

Blog:Do you realize your home equity can be one of your greatest financial resources?

Posted on

|

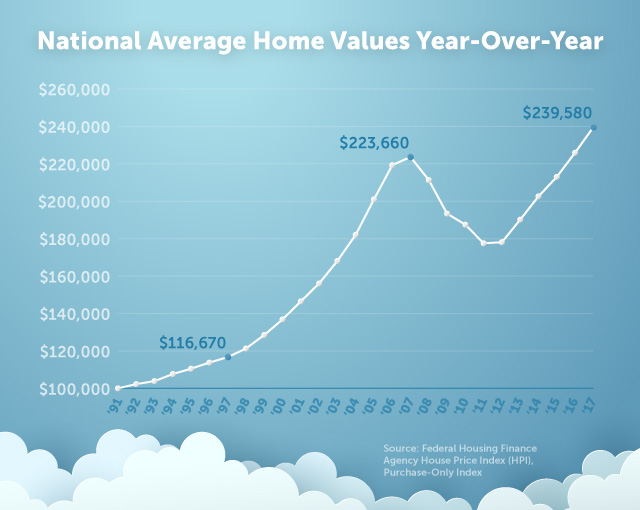

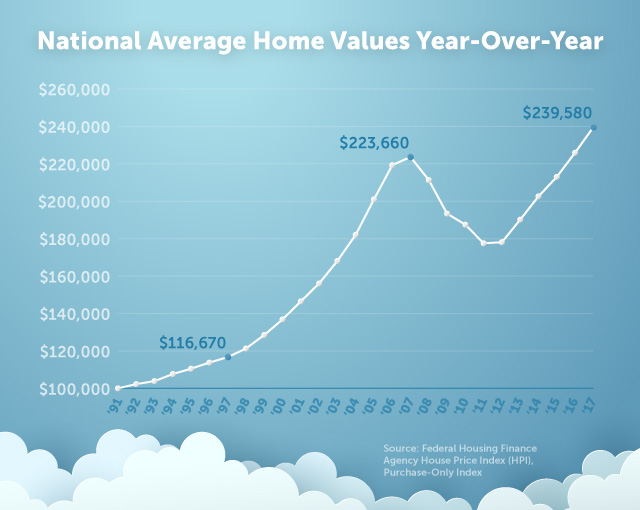

It's true that as you pay down your mortgage, you build equity (the amount of your home you actually own). But as your home appreciates in value each year, it also helps you build equity without having to lift a finger. This equity becomes a valuable asset you can leverage to help you meet other financial needs. The Power of Appreciation Since 1991, home values have increased an average of 3.3% each year, according to the Federal Housing Finance Agency's (FHFA) House Price Index (HPI). Just in the past year, home prices went up an average of 6.0% across the country. The chart below shows how home prices have generally risen over the past 26 years. As you can see, current home values have bounced back well over the peak of the housing bubble. That means, based on appreciation alone, there's a good chance that you may have equity to tap into. |

|

|

In other words, you could be sitting on a pile of cash. Cash Out Your Equity, Meet Your Goals! Saving up enough money to meet your financial goals can take years. By refinancing your home, you can cash out your equity and use it for whatever you need, while taking advantage of today's historically low interest rates. Whether you want to pay off debt, buy a car, or renovate your home, leverage the equity in your home to help you meet your financial goals. |

|

Contact TAM today to determine if refinancing is right for you.

|

|

Do you realize your home equity can be one of

your greatest financial resources? It's true that as you pay down your mortgage, you build equity (the amount of your home you actually own). But as your home appreciates in value each year, it also helps you build equity without having to lift a finger. This equity becomes a valuable asset you can leverage to help you meet other financial needs. The Power of Appreciation Since 1991, home values have increased an average of 3.3% each year, according to the Federal Housing Finance Agency's (FHFA) House Price Index (HPI). Just in the past year, home prices went up an average of 6.0% across the country. The chart below shows how home prices have generally risen over the past 26 years. As you can see, current home values have bounced back well over the peak of the housing bubble. That means, based on appreciation alone, there's a good chance that you may have equity to tap into. |

|

|

In other words, you could be sitting on a pile of cash. Cash Out Your Equity, Meet Your Goals! Saving up enough money to meet your financial goals can take years. By refinancing your home, you can cash out your equity and use it for whatever you need, while taking advantage of today's historically low interest rates. Whether you want to pay off debt, buy a car, or renovate your home, leverage the equity in your home to help you meet your financial goals. |

|

Contact me today to determine if refinancing is right for you.

|